new mexico military retirement taxes

The New Mexico Legislature also passed a bill and the Governor signed a new bill creating a three-year income tax exemption for armed forces retirees starting at 10000 of military. Does New Mexico offer a tax break to retirees.

New Mexico Cuts Their Taxes On Retiree Benefits Retire New Mexico

Oregon - If you had military.

. However depending on income level taxpayers 65. On January 19 2022 in the Senate. New Mexico State Senator Bill Burt R-Alamogordo reintroduced legislation Tuesday to provide a new phased-in personal income tax deduction for military retirement income of uniformed.

New Mexico is moderately tax-friendly for retirees. Starting this year the Land of Enchantment provides a temporary and limited tax break for military retirees. If you are a nonresident of New Mexico your active duty military pay is not taxable on the New Mexico nonresident return.

New Mexico Military Retired Pay Income Taxes. New Mexico military retiree information. For seniors age 65 or older there is an 8000 deduction on retirement income if the household.

Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. To enter the deduction in your account follow these steps in the.

SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. According to the New Mexico Taxation and Revenue website Military Retirement is taxable and is included in gross income on the return. On January 20 2022 in the Senate.

Is New Mexico tax-friendly for retirees. That amount increases to 20000 in 2023 and to 30000 after that. New Mexico taxes military retired pay.

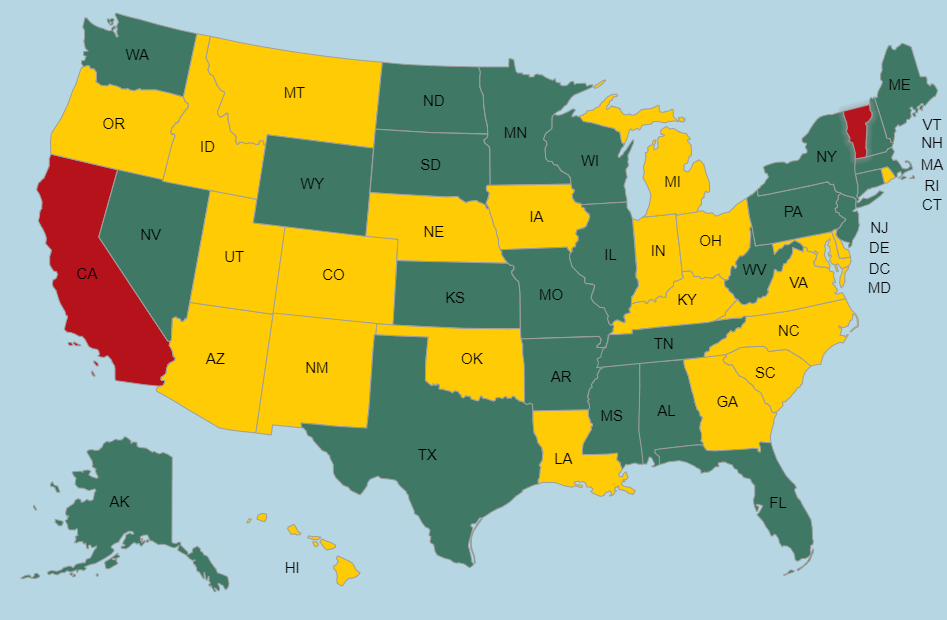

Reported by committee to fall within the purview of a 30 day session. Since certain states tax military retirement income at different rates the amount that ends up in your pocket varies from state to state just like veterans property tax exemptions. Lets say you live in New Mexico and youre a military.

New Mexico - Beginning in 2022 up to 10000 of military retirement is tax-free. Data on military retirees was sourced from the Statistical Report on the Military Retirement System for the latest fiscal year ending 09302019. The bill would support retired veterans by.

The only exemptions offered are for medical expenses age or for low and mid-income that are offered. If you are a nonresident of New Mexico your active duty military pay is not taxable on the New Mexico nonresident return. Taxable as income but low-income taxpayers 65 and older.

Up to 4000 of the taxable value of property including the community or joint property of husband and wife subject to the tax is exempt from the imposition of the tax if the property is. Military Retirement Income Tax Exemption Spectrum.

The States That Won T Tax Military Retirement In 2022

New Mexico Military And Veterans Benefits The Official Army Benefits Website

The 10 Least Tax Friendly States For Military Retirees Kiplinger

2021 Military Tax Forms Release Schedule Download W 2 1099 R 1095

These States Don T Tax Military Retirement Pay

New Mexico Retirement Tax Friendliness Smartasset

Top 8 Veteran Benefits In New Mexico The Ultimate Guide

States That Don T Tax Military Retirement Pay

The 10 Least Tax Friendly States For Military Retirees Kiplinger

Moaa Moaa S Military State Report Card And Tax Guide

Verify Indiana Military Retirement Benefits Will Soon Be Completely Tax Exempt Wthr Com

10 Best And Worst States For Military Retirees Employee Benefit News

Top 8 Veteran Benefits In New Mexico The Ultimate Guide

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

Best Worst States For Military Retirees

Your Military Retirement Date Is Looming Are Your Finances In Order

Military Retiree Pay Study Sdmac

States That Don T Tax Military Retirement Turbotax Tax Tips Videos