how much taxes are taken out of a paycheck in ky

Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. How much is Kentucky income tax.

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

The half that you.

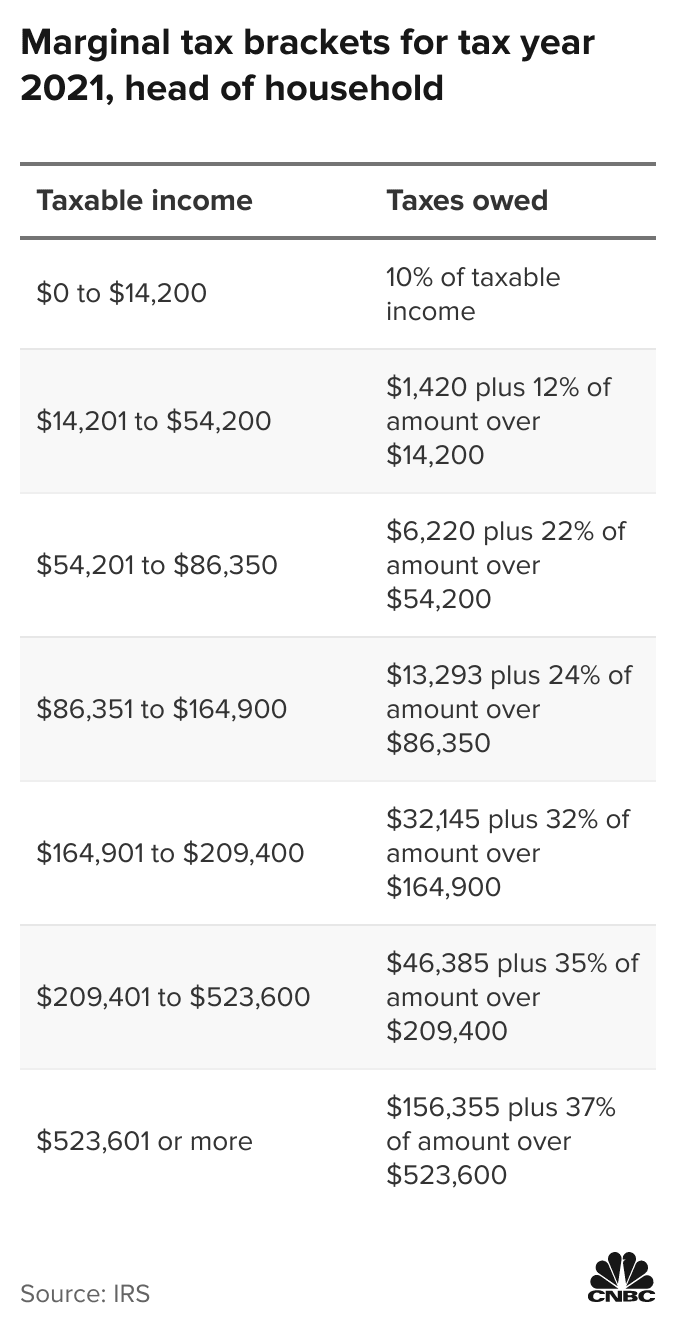

. Both sales and property taxes are below the national average. For a single filer the first 9875 you earn is taxed at 10. At the same time cities and counties may impose their own income taxes to bring the total income tax to 750 in some areas.

If you make 200000 or more your earnings in excess of 200000 are subject to a 09 Medicare surtax not matched by your employer. Kentucky tax year starts from July 01 the year before to. Luckily there is a deduction to help you pay this high.

The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck. Your employer then matches that contribution. There are seven tax brackets that range from 300 to.

Sign Up for a. You can deduct the most common personal deductions to lower your taxable. Overview of Kentucky Taxes Kentucky has a flat income tax of 5.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. That rate ranks slightly below the national average. The number of semis that usually travel my stretch of highway is about a 13 of normal capacity.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers wages. The Medicare tax is 29 of each employees gross wages while the Social Security tax is 124 but employers pay half of that to ease the burden on workers. Yes Kentucky residents pay a flat rate for personal income tax.

Current FICA tax rates. Overview of Kentucky Taxes. Kentucky imposes a flat income tax of 5.

Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. The current tax rate for social security is 62 for the employer and 62 for the employee or. No state-level payroll tax.

Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn. Whenever you get paid regardless of which state you call home your employer will. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

These are contributions that you make before any taxes are withheld from your paycheck. What is the percentage that is taken out of a paycheck. The tax rate is the same no matter what filing status you use.

The income tax is a flat rate of 5. Census Bureau Number of cities that have local income taxes. How Your North Carolina Paycheck.

Only the very last 1475 you. Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly pay. For example if a salaried employees gross pay is 40000 and you want to calculate their monthly.

North Carolina income tax rate. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings Also keep an eye out for online announcements and mailers with bonus offers.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Annual gross salary number of pay periods gross pay for salaried employees. The tax calculator provides a full step by step breakdown and analysis of each.

Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. These taxes together are called FICA taxes.

If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. Employers also have to pay a matching 62 tax up to the wage. No standard deductions and exemptions.

Taxes On Stocks How Do They Work Forbes Advisor

What Is Local Income Tax Types States With Local Income Tax More

Payroll Tax Engine Symmetry Tax Engine

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Missouri Income Tax Rate And Brackets H R Block

2022 Federal State Payroll Tax Rates For Employers

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Single Vs Head Of Household How It Affects Your Tax Return

How Is Cryptocurrency Taxed Forbes Advisor

When You Make Pre Tax 401 K Contributions You Won T Miss The Whole Amount From Your Paycheck Financial Literacy Lessons Personal Finance Lessons How To Plan

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Payroll Taxes Methods Examples More

Kentucky Paycheck Calculator Smartasset

1 200 After Tax Us Breakdown August 2022 Incomeaftertax Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time